]

Coinspeaker

Abstract’s Struggles: Pudgy Penguins’ Layer-2 Fails to Hold Liquidity

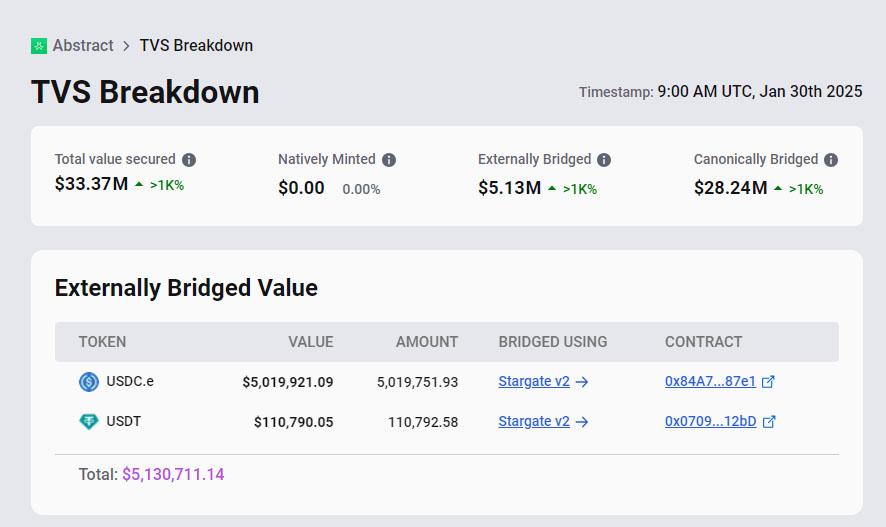

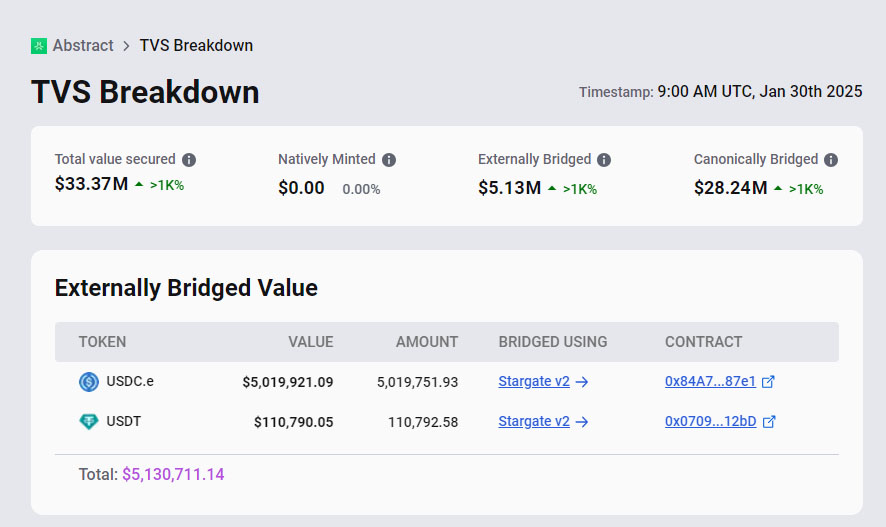

Abstract, the new layer-2 network launched by Pudgy Penguins, debuted with strong initial traction but has struggled to secure liquidity. Despite recording 711,000 transactions on the first day, capital inflow has remained limited. Total value secured (TVS) currently stands at $33.37 million, a figure significantly lower than the multi-billion-dollar benchmarks set by other high-profile layer-2 networks.

Source: L2Beat

NOXA, the decentralized exchange operating within the network, reflects an even more concerning trend. Total value locked (TVL) plunged from $515,000 at launch to $109,231, according to DefiLlama data. That sharp decline underscores investor reluctance to commit assets, even with a streamlined onboarding process enabling wallet creation via email.

Source: DeFiLlama

Abstract implemented an incentive mechanism granting “xp points” for mainnet interactions. However, the approach has failed to generate widespread enthusiasm. A community member on X expressed frustration, emphasizing that most participants prioritize NFT trading over accumulating xp.

There’s no liquidity on Abstract – but will it ever come?

First thing I saw in my TL today was FUD and drama around Abstract✳️

Many are calling it a failure because their WLs (earned through threads) didn’t meet expectations due to a lack of liquidity

But why is there no… pic.twitter.com/mKLqJxxGHK

— Sanix𝕏x.eth (🪹,🦉) (@0xSanixxx) January 29, 2025

No DeFi? No Problem, Says CEO

Unlike other Ethereum-based layer-2 solutions that emphasize deep DeFi integration, Abstract aims to carve a different path. Users can bridge funds, swap tokens, and even launch new tokens on zoo.fun, Abstract’s equivalent of the pump.fun token launcher. But instead of focusing on financial applications, CEO Luca Netz has championed a vision centered around entertainment.

“If it’s not fun and viral there’s no reason for you to build on Abstract. I’m optimizing for fun, viral, simple, stupid. If you want to build the next DeFi application, I really recommend you use Berachain or Arbitrum,” Netz said.

That unconventional approach sets Abstract apart, but it may also explain the struggles in attracting deep liquidity. DeFi projects typically drive the most capital flow on blockchain networks, and by steering clear of that sector, Abstract may have limited its initial appeal.

PENGU 37% Drop In a Week

The sluggish start of Abstract has had ripple effects beyond just the network. Pudgy Penguins’ native token

PENGU

$0.0152

24h volatility:

4.4%

Market cap:

$958.34 M

Vol. 24h:

$276.28 M

has tumbled 6% in the past 24 hours and a staggering 37% over the past week. While the broader crypto market has also cooled, some traders believe PENGU’s steeper losses stem from unmet expectations.

“The reaction suggests that [Pudgy Penguins NFTs] were being priced with the expectation of a mainnet [token generation event] with a healthy drop to Pudgy holders, not a prolonged XP/Points program,” said Parsec Finance.

The downturn in PENGU echoes a larger trend within the NFT space. Despite a spike in December amid airdrop speculation, OpenSea’s trading volume in January is hovering around $15 million per day, a dramatic fall from the $160 million daily average seen in 2022. The NFT sector has yet to reclaim the explosive momentum of its last bull cycle.

next

Abstract’s Struggles: Pudgy Penguins’ Layer-2 Fails to Hold Liquidity