]

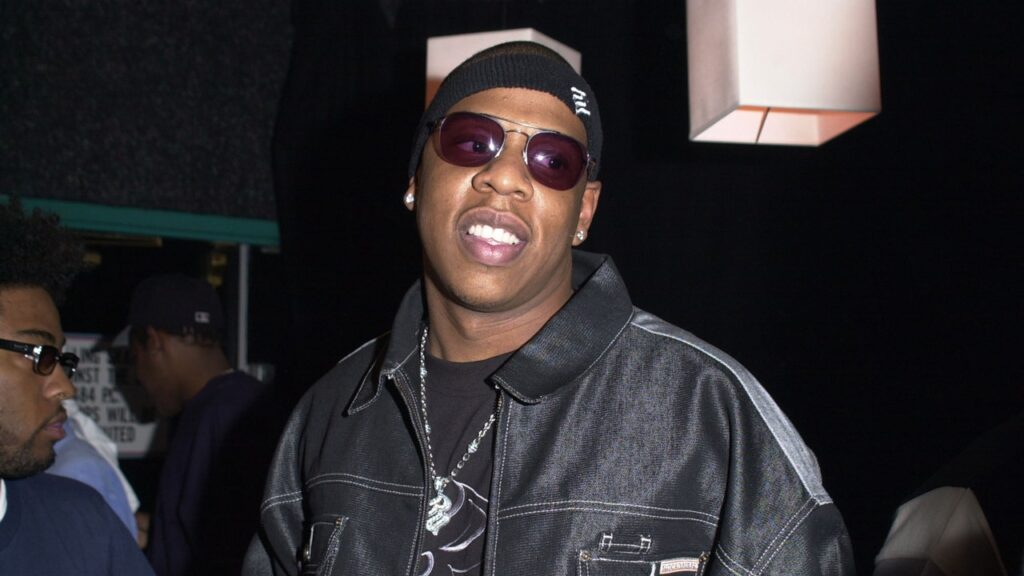

Customers purchase fruit at a supermarket on December 9, 2024 in Qingzhou, Shandong Province of China.

Vcg | Visual China Group | Getty Images

China’s consumer price inflation in December slipped to 0.1% year on year, data from the National Bureau of Statistics showed Thursday, stoking deflation concerns.

Growth in headline inflation was in line with Reuters estimates, but less than the 0.2% rise in November. Core CPI, which excludes food and energy prices, rose 0.4% year on year compared with 0.3% rise in the previous month, the data showed.

On a month-on-month basis, China’s CPI came in flat, compared with the 0.6% decline in the prior month.

Food prices fell by 0.6% month on month as a result of conducive weather conditions, official statistics showed. The prices of fresh vegetables and fruits fell 2.4% and 1%, respectively. Prices of pork, which makes up a significant portion of the CPI basket, fell 2.1%.

“Headline CPI will be negatively impacted by the weaker pork price in 2025,” analysts at ANZ Bank wrote in a note. On a year-on-year basis, pork and fresh vegetable prices remain elevated, climbing 12.5%.

Wholesale prices continued to be fall for a 27th straight month, with China’s producer price inflation down 2.3% year on year in December. The reading was slightly better than Reuters estimates of a 2.4% decline.

On a monthly basis, PPI dipped by 0.1% compared to a 0.1% increase in November, as infrastructure and real estate projects were temporarily suspended during the off-season, the National Bureau of Statistics said, hurting demand for steel.

The ongoing near-zero consumer inflation indicates that China continues to struggle with weak domestic demand that has raised the specter deflation.

Consumption has failed to pick up despite a range of stimulus measures introduced by Beijing since last September, which encompassed interest rate reductions, support for the stock and property markets and increased bank lending.

As recent as Wednesday, China expanded its consumer trade-in scheme aimed at spurring consumption through equipment upgrades and subsidies.

Certain metrics, however, signal China’s economy could see some recovery. The country’s factory activity has been expanding for the past three months, although the pace of expansion slowed in December.

“Although China’s economy displayed some signs of recovery following the policy shift in September, it continues to face significant challenges,” said Carlos Casanova, a senior economist at private bank Union Bancaire Privée, citing the country’s property sector headwinds and trade tensions with the U.S.

Louise Loo, lead economist at Oxford Economics expects that China’s path to reflation will still underwhelm most estimates given the enduring weakness in consumer spending appetite.

China’s onshore yuan on Wednesday hit a 16-month low of 7.3316 against the dollar as Treasury yields rose and the dollar strengthened.