]

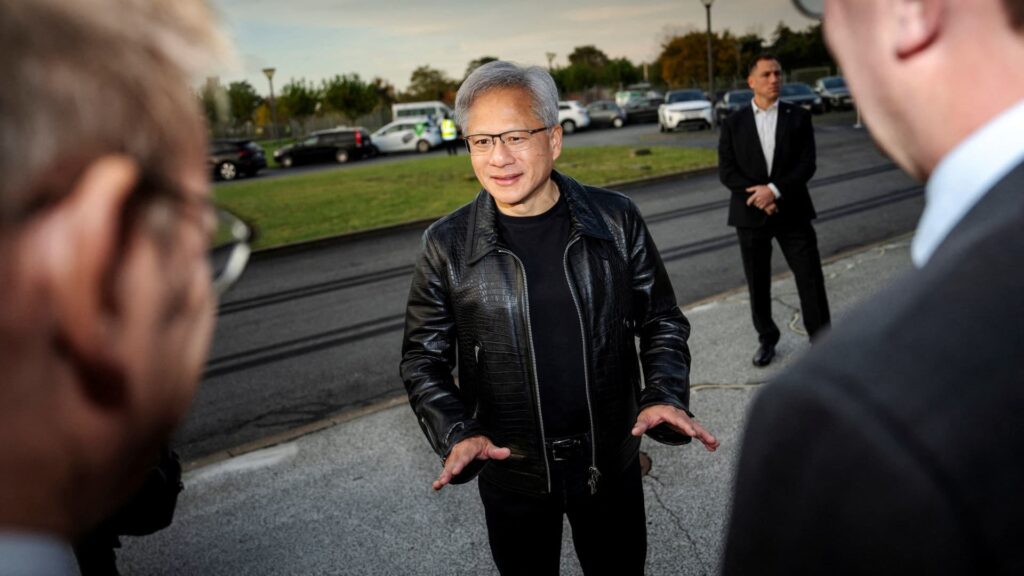

Nvidia CEO Jensen Huang delivers the keynote for the Nvidia GPU Technology Conference at the SAP Center in San Jose, California, on March 18, 2025.

Brittany Hosea-small | Reuters

Technology stocks dropped Wednesday, led by a 10% plunge in Nvidia, as the chipmaking sector signaled that President Donald Trump’s sweeping tariff plans could hamper demand and semiconductor growth.

Nvidia revealed in a filing Tuesday that it will take a $5.5 billion charge in the first quarter tied to exporting its H20 graphics processing units to China and other countries.The government will also require a license to ship the chips there and other destinations, the company said.

The chip was designed specifically for China use during former President Joe Biden’s administration to meet U.S. export restrictions barring the sale of advanced artificial intelligence processors, which totaled an estimated $12 billion to $15 billion in revenue in 2024. Advanced Micro Devices said in a filing Wednesday that the latest export controls on its MI308 products could lead to an $800 million hit.

Nvidia and AMD shares over the last month

Tech volatility

Investors had hoped President Trump’s new term in office would usher in a period of strength for the technology sector. The hopes helped power the market to new highs in the post-election market rally and sent top tech executives to Washington to show their support at the inauguration.

But technology stocks have recorded significant market cap losses since the January, whipsawing in the wake of Trump’s tariff announcements, which sparked global trade war fears and recession concerns. Year to date, Nvidia, Apple, and Amazon have lost about a fifth of their value, while Tesla is down a earth-shattering 24%.

Ongoing tariff uncertainty has created a volatile stretch for global markets. Stocks initially fell on the news, pushing megacap technology stocks dubbed the “Magnificent Seven” to shave off more than $1.8 trillion in market value over two trading days. The wild turbulence continued as Trump later announced a 90-day pause on most reciprocal tariffs, sending the Nasdaq Composite to its second-best session ever last week.

While technology stocks have bounced from their lows, megacaps sit well off their highs. Apple and Meta Platforms are down more than 12% each in April, while Amazon and Tesla have slumped more than 8%. Nvidia is down about 7%.

WATCH: Chip stocks fall as Nvidia, AMD warn of higher costs from China export controls