]

Coinspeaker

Jupiter Holds Strong Above $0.70: Will It Rally to $1?

With Solana and Solana-based coins gradually recovering after the recent meme coin controversy, Jupiter is making headlines. With a 4.44% intraday rise, Jupiter price

JUP

$0.78

24h volatility:

6.8%

Market cap:

$2.04 B

Vol. 24h:

$279.20 M

action hints at a new Morning Star pattern, sustaining dominance above the $0.70 mark.

This short-term reversal in Jupiter aims to regain the bullish trend. However, the breakdown of the crucial $0.77 support zone warns of a post-reversal pullback.

Jupiter’s Recent Downtrend & Rejection at $1

In the daily chart, the JUP price action reveals four consecutive bearish engulfing candles. The downfall resulted in a 25% pullback from $0.95 to $0.71. If Jupiter can successfully reclaim the $0.77 level, it could signal the beginning of a new bullish rally. Furthermore, it might show potential to challenge the $0.95 mark.

The bearish reversal came after facing an overhead rejection near the $1 psychological mark. Furthermore, it coincided with the meme coin controversy within the Solana ecosystem.

As Solana memecoins still struggle for a bullish uprising, Jupiter is bouncing off from the $0.711 support level. However, the increased bearish influence has resulted in a death cross event between the 50 and 200 EMA lines.

Furthermore, the 100 and 200 EMA lines are on the verge of giving another bearish crossover, completing a full bearish alignment. Despite multiple bearish crossovers, the short-term reversal results in an uptick in the daily RSI line within the nearly oversold region.

Parallel Channel Indicates Possible Recovery

In a recent X post, Ali Martinez, a crypto analyst, highlighted a parallel channel in Jupiter’s price action. The lower band of the parallel channel is at $0.69.

#Jupiter $JUP is approaching a critical support level at $0.69, which could provide the foundation for a rebound toward $1! pic.twitter.com/AZBqH9FDAc

— Ali (@ali_charts) February 20, 2025

As per the current price action, the JUP token price has made a bullish reversal, increasing the chances of a potential comeback towards the $1 psychological mark. On the flip side, the crucial support levels for Jupiter remain the $0.71 horizontal level and the $0.65 psychological mark.

Jupiter’s TVL & Market Performance

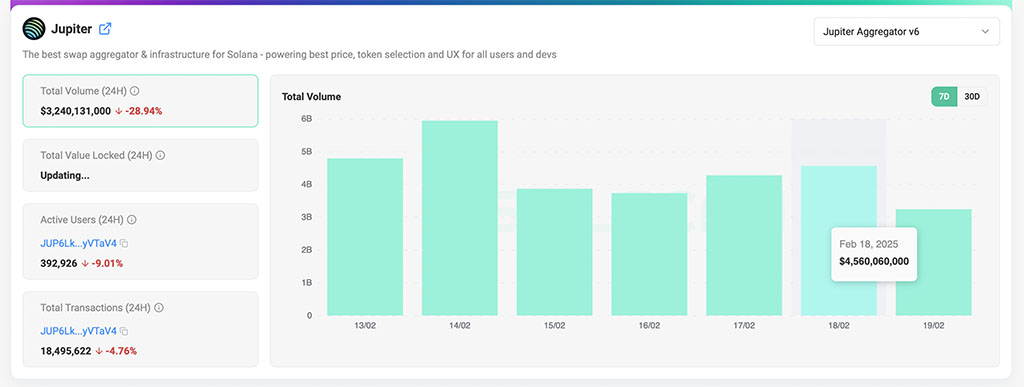

Jupiter holds a total value locked (TVL) of $2.51 billion. Since the start of 2025, the TVL of Jupiter has been fluctuating near this crucial level.

This marks a short-term pullback from its all-time high TVL of $2.922 billion recorded on January 23. With the massive TVL, the 24-hour JUP total volume stands at $3.24 billion.

However, this marks a 29% drop over the total 24-hour volume. Furthermore, active users have declined by 9% over the past 24 hours and now stand at 392,926 active users.

Meanwhile, the total transactions over the DEX are close to 18.5 million. Overall, the numbers reflect a pullback phase. However, despite the bearish pressure, Jupiter’s ability to hold above the $0.70 mark suggests underlying strength. This could act as a catalyst as a potential market recovery due in coming weeks.

next

Jupiter Holds Strong Above $0.70: Will It Rally to $1?